Yesterday, I gave a presentation on my “Be Your Own CFO” concept to subscribers of Leo Babauta’s Sea Change program. For an hour, I talked about how (and why) to treat your personal finances as if you were managing a small business.

As always, one of the key components of my message was that people ought to do what they can to save money on the big stuff. By making smart choices in just three areas — housing, transportation, and income — you can achieve outstanding personal profit with minimal effort. That is, you can create a huge gap between your earning and spending if you’ll take steps to reduce your housing costs, trim your transportation expense, and increase your income.

Obviously, these things are easier said than done. If you’ve already bought a large, expensive house in suburbia, it’s tough to simply say, “I’m out of here.” For one, it takes time to sell your place and move into something smaller (and cheaper). For another, if you’re accustomed to a certain lifestyle, the transition to something more minimal can be shocking at first. (Although, from the people I’ve talked to, once the transition is made, it’s easy to maintain the new modest lifestyle.)

What was different about yesterday’s presentation, though, was the role that cost of living played in my thoughts — if not my actual delivery.

Right now, Kim and I are stranded in rural South Dakota. While driving from the Badlands to De Smet (real-life site of Laura Ingalls Wilder’s “little town on the prairie”), our RV engine blew up. For the past week, we’ve been stuck in Plankinton (population 707) while we wait for a new engine to arrive and be installed.

I won’t pretend that Plankinton is paradise. It’s hot and humid here. There’s little to do besides sit and drink beer with the locals during the evening. (Which is fun, don’t get me wrong.) There aren’t a lot of job opportunities. The socio-political vibe doesn’t match our own.

What Plankinton does have, however, is cheap prices. This morning, for instance, I paid $10.60 for a fancy men’s haircut. At home in Portland, I pay $28 for the same fancy haircut. Six weeks ago, I paid $30 for the same cut in Fort Collins, Colorado. In Santa Barbara, California, I paid $50 or $60 for the same fancy cut.

Gas is cheaper here too. So is food. So is beer and whisky. So are movies. So is just about everything, including housing. Housing prices follow a similar pattern to the haircut prices I mentioned above. A $280,000 home in Portland might go for $300,000 in Fort Collins and $500k to $600k in Santa Barbara. Here in South Dakota, that same home would cost about $106,000.

Cost of living differences can be huge from one country to another, from one state to another, and from one city to another. In large cities, there are even differences between neighborhoods. (Groceries are more expensive in Portland’s posh West Hills than in low-rent Oak Grove, for instance.)

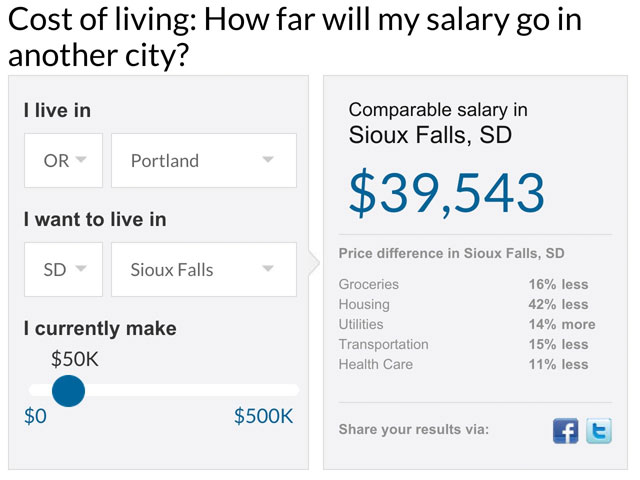

For fun, take a look at CNN’s cost-of-living calculator, which will allow you to compare expenses from one city to another. For instance, here’s the difference between home and here:

The lesson here? If you truly want to achieve a Big Win on your housing costs, it pays to expand your search, to take into account cost of living. If you have a fixed budget, you’ll get more bang for your buck by buying a house in Oklahoma City or Sioux Falls than by purchasing in San Francisco or Seattle. If, like me, your work is location independent, it makes much more sense to live in Omaha, Nebraska than New York City. Your income is the same in both places; but in Omaha, your get much more for your money.

Now, obviously there’s more to consider in a decision like this than pure price. As I always say, money management is more about mindset than math. We are emotional creatures, and we don’t make financial decisions based purely on the numbers. When you choose a place to live, you do so because of the climate, the politics, and the people. You want to live close to friends and family. You want a nice school district. You want people who think and act the same way you do. For those reasons (and others), South Dakota might not be a good choice for you.

But I believe you should take cost of living into account when deciding where to live. Housing is far and away the largest piece of the average American budget, roughly one-third of the typical household spending. The best way to cut your costs (and, therefor, boost your profit/savings) is to reduce how much you spend on housing. And the first step in reducing your housing expense is to choose a cheap place to live.

I wish i had access to this information years ago, before we decided to buy a house. If i had a do over id push much harder for a smaller, cheaper place.

$500-$600k for a house in Santa Barbara???? Add another zero to those numbers. I used to live there and it is ridiculously expensive. They are having a hard time keeping people there because nurses and waiters can’t afford it.

This is exactly what we realized a while back and why we are going nomad.

Location-independent income is key, of course, but experience tells me that one can have most anything if strong desire is coupled with action.

Many times, though, people are too quick to judge whether a place (politics, people, climate) is right or wrong for them. It’s so easy to think you understand more than you do about a place.

If my goal was financial, I’d make that the deciding factor, or at least weight that factor heavily. You can always move when your goal is reached! In the mean time, you might get some new perspective.

Food for thought.

Winslow

We relocated from a very high cost area (SF Bay) to only a high cost area (northern AZ). 🙂 That move was a huge improvement in our cost of living, resulting in less of our net worth tied up in our home.

Now we are considering a move to an inexpensive location/ home as our new base so that we focus more on traveling and less on work and passive income. Heck, we are even contemplating the option of renting for a while, until we know where we really want to settle down for the long term.

Its much more expensive here in Portland than it was even 5.5 years ago when I moved here to escape the Bay Area’s high cost of living. When relocating, there is much more to consider other than just cost of living. Sure there are cheaper places to live but I need to consider my health care while living with a chronic illness, the social structure, race relations (especially while black in an interracial marriage) and so on. Having always lived in walkable areas and moderate climates, I can’t imagine living where I would need a car 100% of the time. We do own and use a car but I enjoy being able to walk to local stores and businesses.

Great advice about house buying. Luckily, we’ve always adhered to the idea of buying houses close to work since we have one car, and we always bought quite a bit less house than the realtors/lenders said we could afford. Actually, I was horrified to have to pay over $200k when we moved to Corvallis, OR.

When I read that the cost of housing in Fort Collins was more than Portland, I looked on a couple of different websites to see what the home we bought in Fort Collins in 1988 would sell for today. Yikes! We couldn’t afford to buy it now, just as we couldn’t afford to buy our first house in Lake Oswego nor the one in Corvallis we sold in 2008.

Herein, 75% of the reason we are buying property up a hill in the Sierra rather than trying to buy in the L.A. metro area. Yes, we will not be able to live in an owned home until we retire. But once we do retire, our cost of living will be approximately 25% of what it is now.

You mentioned it in passing, but I’d like to reiterate that it may be wise to expand assessing living expenses to include places outside the U.S.

I have more than a few friends who have or are planning to move to various Latin America locations. For instance, food and housing in Acapulco is very cheep (to rent), and although I’ve heard owning a car there is expensive, it is a joy to walk and take the local buses.

Puerto Vallarta is a little more expensive but still cheaper than Portland Oregon. It’s a more touristy and polished area than Acapulco and easier for English speaking folks to assimilate.

If my income was location independent, I’d already be there. 😉

Funny enough, I know where that is. I used to visit housing authorities all over South Dakota and one of them was in DeSmet too. Mitchell isn’t too far away from where you are, if you end up needing civilization. By civilization, I mean Ruby Tuesdays, where you can get a salad made up of lettuce other than iceberg.

I looked up the calculator because I would like to get back to Denver one day, but housing is 33% more than here in the DFW. I knew that but to see the number made me wonder if I could make Texas work?

Good article and best of luck on that engine. I hope you’re having a some decent walleye. Believe it or not, there is some great food in downtown Sioux Falls, if you happen to make it that way.

I watched the webnair, it was awesome! I LOVE the idea of being CEO of your own life. Take control of your own life. and I LOVE the idea you said that this we should have our own mission statements. But how to create my own mission statement? Any suggestions?

I lived in Sioux Falls for 3 years and was surprised of how low the cost of living was. I was making $11-12 an hour 32 hours a week and had enough money to pay for the things I needed and have leftover money.

It’s a great little city also! It has a lot of the amenities as a big city but has more of a relaxed and small town vibe. I wouldn’t oppose to moving back if I had the chance.